flow through entity private equity

Business taxed as a partnership. Blocker corporation to hold an investment in a US.

An LLC is a pass-through entity for tax purposes so a private equity fund invests in it.

. Investor generally will not. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals. Often the owners of a corporation must take a.

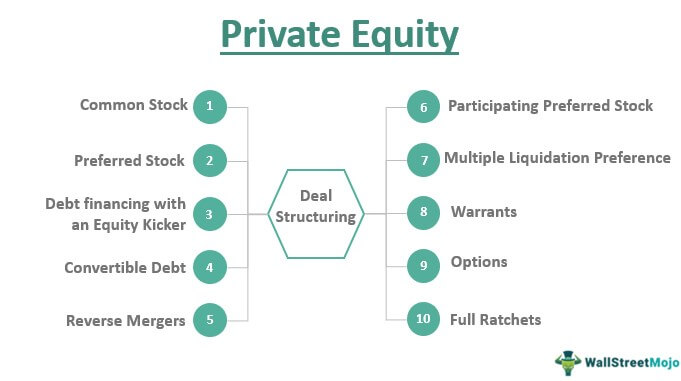

The difference between cash flow splits versus true promotes is a topic that often raises questions for retail investors and for good reason. In this stage of the private equity investment process flow chart the deal team typically interacts with the investment bank and the management of the target company on a daily basis. 99-6 where 100 of the interests in an entity taxed as a partnership are acquired the purchaser is treated as having acquired the assets of the entity in a taxable asset purchase2 This is the optimal result for tax purposes for the acquiror.

In this legal entity income flows through to the owners of the entity or investors as the case may be. This is generally comprised of a General. Investors such as sovereign wealth funds to own their indirect interests in certain types of fund investments through an entity taxable as a US.

We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based. Most of the income of most private equity and venture capital funds will consist of gains from the sale of portfolio. The entity passes its total income to the entitys owners and therefore taxes are calculated on the individual basis on each and every owner.

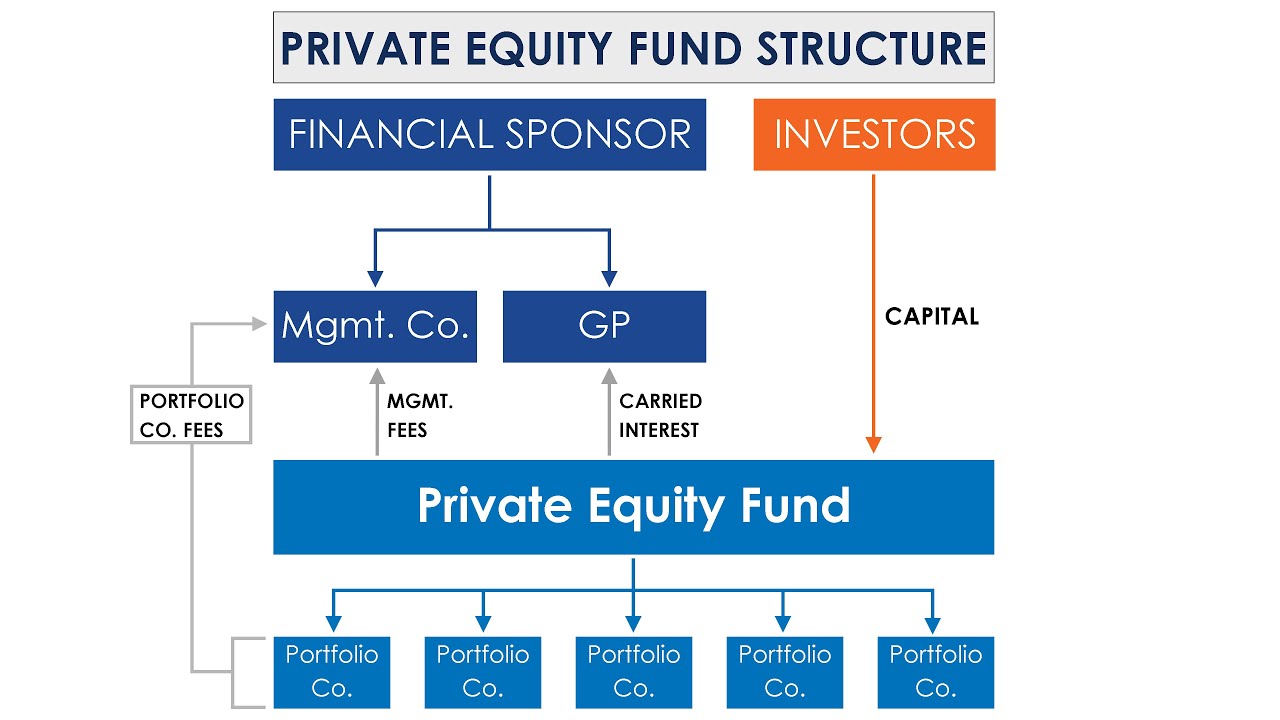

States real property interests USRPIs or interests in flow-through entities themselves engaged in a US. That is the income of the entity is treated as the income of the investors or owners. 1 Financial Sponsor Sponsor in image.

Flow-through portfolio company as the court decision may permit the non-US. Hence the use of a US C corporation as a blocker corporation to block the flow-through of income on a Schedule K-1 at the corporate level. 2 LPs and LLCs are pass-through entities for federal income tax purposes.

Blocker to exit its investment in the US. They dont pay taxes but they must file taxes. It is typical in private equity funds for certain tax-sensitive investors including US.

Analogies aside here are the basic points of flow-through aka pass-through entities. Through this arrangement business owners and shareholders only pay taxes on their personal income generated through this business and dont have to pay additional corporate taxes for running. Common types of FTEs are general partnerships limited partnerships and limited liability.

In addition the non-US. The purpose of flow-through tax forms is to attach income to a tax-paying entity namely you. The pass-through entity can be defined as a process by which any organization will be relieved from double taxation burden.

Hence the income of the entity is the same at the income of the owners or investors. For instance an individual in a 50 tax bracket who invests 20000 in a flow-through offering is really only risking 10000 since he receives 10000 in tax deductions. The reason for passing through income structure is that the owners otherwise get double taxed.

Flow-through shares significantly reduce the risk of investing in resource stocks by allowing investors to recover a substantial portion of their original investment through income tax savings. There are many PEVC funds with limited partners such as pension funds or non-US. So neither foreign or tax-exempt investors want to hold directly an equity interest in a US.

Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. The team of individuals that will identify execute and manage investments in privately-held operating businesses. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

Planning devices can include the following. Corporation a so-called Blocker which insulates such investors from the direct obligation to pay US. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible economics a control vehicle and the ability to grant profits interests as a compensation incentive discussed below.

Impact of the 338h10 Election on a Stock Sale. The GP and LP equity are now in distinct entities and the JV LLC Agreement dictates how cash flow is divided between the two entities as well as how control is allocated. Flow-through entities are also known as pass-through entities or fiscally-transparent entities.

This is done via the Schedule K-1 on Form 1120S. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation. They will send requests to the target company to address any outstanding issues such as visit requests calls with sales personnel non-executive management customers and suppliers.

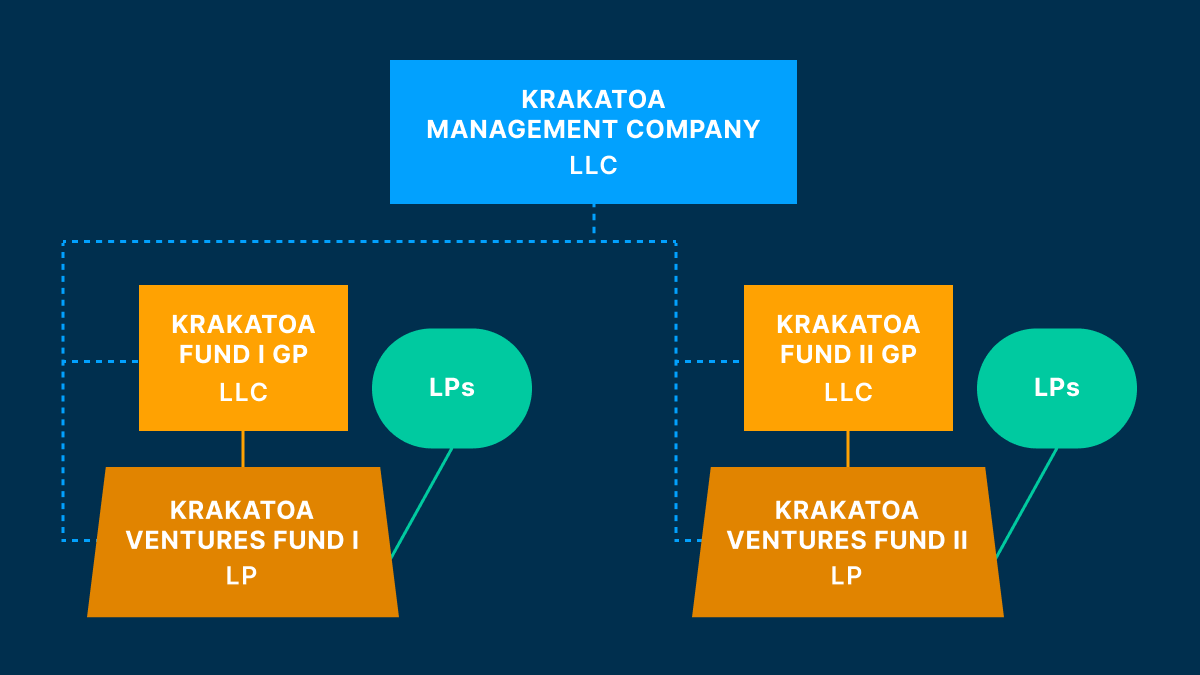

Raising a private equity fund requires two groups of people. Blocker corporation rather than a US. Typical features of the general partner in a basic private equity structure Usually a US or flow through entity in which the participants include - Principals - Can be an investment bank or other financial institution provide services as employees Features of the management company a US or flow through entity Participants.

Sovereign wealth funds are among these investors. Tax exempts and non-US. Trade or business flow-through operating entities.

ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. A flow-through entity FTE is a legal entity where income flows through to investors or owners.

Private Equity Fund Structure A Simple Model

Aqa As Business Understanding Different Business Forms Website Teaching Business Study Notes Aqa

The Legal Structures Of Venture Capital Funds Carta

How To Get Approved By Private Label M A P And Exclusive Dropshipping Suppliers Keep In Mind Trust Yourself Dropshipping Suppliers Internet Marketing

Financial Statement Analysis An Introduction

Private Equity Meaning Investments Structure Explanation

Pass Through Entity Definition Examples Advantages Disadvantages

Converting A Sole Proprietorship Into A Singapore Private Limited Company

How Private Equity Firms Raise Money Private Equity How To Raise Money Equity

Free 10 Hvac Business Plan Templates In Pdf Ms Word Intended For Free Hvac Business Plan Template 11 Professional Templates Ideas

Pass Through Entity Definition Examples Advantages Disadvantages

Future Fund Raises 3 8m To Build A Crypto Micro Investment Platform Fueled By Cashback Rewards

Stock Talk New Brand Names For The New Decade 2020 30 Movie Market Brand Names Jet Airways

How To Find Private Money For Real Estate Investing Free Video Training Real Estate Investing Getting Into Real Estate Real Estate Tips

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

Relevant Cost Vs Irrelevant Cost All You Need To Know

Private Equity Fund Structure A Simple Model

Hedge Fund Vs Private Equity Meaning Differences Examples And More