arkansas estate tax statute

26-26-1202 states that personal property of any description shall be valued at the usual selling price of similar property at the. Online payments are available for most counties.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Personal Property - Under Arkansas law ACA.

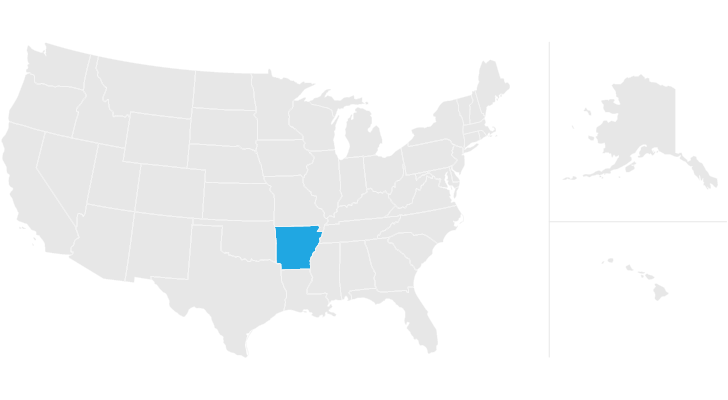

. Locate contact information for your county assessor and tax collector. Whether you have a 50000 or 5000000 house you will owe Arkansas property taxes. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

AR1002ES Fiduciary Estimated Tax Vouchers for 2022. The statewide property tax deadline is October 15. Pay-by-Phone IVR 1-866-257-2055.

Assess Pay Property Taxes. If any person for the purpose of avoiding listing for the payment of taxes on any property subject to taxation shall sell give away or otherwise dispose of the property under or subject to any agreement expressed or implied or any understanding with the purchaser done or recipient of. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc.

As far as gift taxes go Arkansas also does not have a state gift tax. This means that you may gift up to 15000 per person per year without worrying about tax consequences. Welcome to FindLaws Arkansas Tax Laws section which covers personal income tax use tax and the various types of consumer taxes levied in the state.

Justia US Law US Codes and Statutes Arkansas Code 2010 Arkansas Code Title 28 - Wills Estates and Fiduciary Relationships Subtitle 4 - Administration Of Decedents Estates Chapter 41 - Distribution Without Administration 28-41-101 - Collection of small estates by distributee. Be sure to pay before then to avoid late penalties. If you are a senior citizen owning a property and living in Arkansas you may qualify for the following property tax exemptions.

If you gift more than that amount to someone you must report it to. Thats the fifth lowest in the nation where the average is 31 percent and lower than all our neighbors roughly equal to Oklahomas. Age 65 or Disabled Homeowner Property Tax Relief.

Market Value - ACA. AR4FID Fiduciary Interest and. There is no minimum or maximum amount to pay on your property taxes in Arkansas.

DoNotPay provides information on all senior citizen property tax exemptions and the two above-mentioned options. Ad The Leading Online Publisher of National and State-specific Elder Law Legal Documents. Of all taxes collected in Arkansas state and local combined 181 percent comes from property taxes.

26-1-101 personal property is defined as Every tangible thing being the subject of ownership and not forming a part of any parcel of real property as defined. Disposition of property to avoid assessment. Fiduciary and Estate Income Tax Forms 2022.

Property taxes paid to the county government are a major source of local government funding and are due on October 15 each year. The amount of taxes due annually is based on the assessed value of the property. Even if the property was gifted to you through an estate or you own a rental property you are still required to pay property taxes by Arkansas law.

2010 Arkansas Code Title 26 - Taxation Subtitle 2 - Administration Of State Taxes Chapter 18 - State Tax Procedure Generally Subchapter 3 - Administration Generally. When a property owner fails to timely pay the assessed tax the property may become subject to sale by the State. Arkansas Property Tax Statutes 26-2-107.

Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Arkansas like other states has what is known as a progressive tax system in which higher income individuals pay a higher percentage of their income in taxes while those with less income pay a smaller percentage. Learn about Arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return.

At the federal level the federal gift tax makes an exclusion of 15000 per year per gift recipient. Our two neighbors without income taxes Tennessee and Texas rely much more on property taxes. Arkansas state income tax rates range from 0 to 59.

Arkansas Estate Tax Everything You Need To Know Smartasset

Tips To Avoid Tax Troubles While Working From Home Money

Arkansas Estate Tax Everything You Need To Know Smartasset

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Reducing Capital Gains Taxes On A Rental Property Smartasset

How Short Sales And Foreclosures Affect Your Taxes Turbotax Tax Tips Videos

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States Are Imposing A Netflix And Spotify Tax To Raise Money

State Death Tax Hikes Loom Where Not To Die In 2021

Learn More About Arkansas Property Taxes H R Block

State Corporate Income Tax Rates And Brackets Tax Foundation

Tax On Streaming Services Deloitte Insights

Eliminating Its Income Tax Will Help Arkansas S Economy

Property Taxes By State Quicken Loans

:max_bytes(150000):strip_icc()/shutterstock_136842914-5bfc367e46e0fb00511c070b.jpg)

10 Best States For Property Taxes And Why

Where Not To Die In 2022 The Greediest Death Tax States

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Still Working Remotely Your 2021 Taxes May Be More Complicated

Washington Quit Claim Deed Form Quites Washington Sheet Music